Test

This is a test.

TEST

This is a test

Related Posts

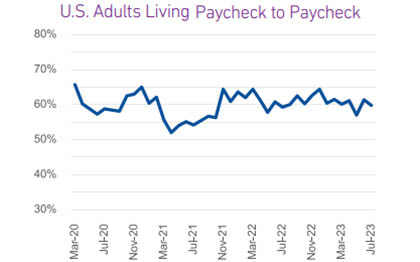

The aggressive interest rate hikes instituted by the Federal Reserve over the past year and a half may have achieved the desired goal. Easing inflation (3.2% in October) and strong GDP growth (4.9% in Q3) are some of the first indications that the economy may experience the “soft landing” hoped for instead of a recession. The consistently strong labor market produced low unemployment and increasing wages, enabling personal spending to increase. However, while spending continues to grow, the growth rate is on a downward trend. The high rate of spending has been driven by consumers digging into savings and borrowing more. As savings dwindle and the cost to borrow increases, it is likely that consumers will retreat and the pull-back will likely hit discretionary categories first. What I am watching: Heading into the holiday season, consumer spending is still strong but how long will it last? The National Retail Federation is projecting that November and December retail sales will grow 3-4% which is in line with the 3.6% average increase from 2010-2019 but lower than the past three years. People are already dipping into savings and borrowing more to continue their consumption but that well will run dry at some point. In addition, 36% of consumers cite December is a month for seasonal financial distress, according to PYMNTS. While consumers may continue spending through the holiday season, the tide may turn in early 2024 when bills hit with higher interest rates. Download Full Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

Published: Nov 20, 2023 by Marsha Silverman

Join us for a 15-minute Sip

Published: Sep 02, 2022 by Gary Stockton

If you want to get the most out of your marketing campaigns, it's important that they are tailored for a specific audience. We invited Tony Romero on Business Chat to talk about part two of his three-part Sip and Solve webinar series focused on B2B marketing where he explains how segmentation and targeting can make all aspects (landing page or email) more effective by using industry SIC as well as NAICS codes. Look-a-like analysis CMO's challenged with restricted budgets Analyzing portfolio diversity and targeting minority-led, women-led businesses Profiling prospects with limited data attributes Watch Our Interview What follows is a lightly edited transcription of our talk. [Gary Stockton]: So in our last chat, we talked about maintaining robust marketing data to power effective campaigns and how clean data really helps businesses conduct effective marketing campaigns. This week, we switch gears to discuss the power of segmentation and targeting using industry SIC and NAICS codes to optimize your marketing budgets. So let's dive in. In our previous chat, we spoke about the changes that tech companies have enacted to make the job of targeting business prospects harder, but it's not game over for marketers. [Tony Romero]: No, definitely not. You know, it's really important to know that there's still a lot of a wealth of data out there that can be used to identify and segment target customers. You know, the first-party data obviously is really key, as well as being able to take information that may be spotty. If, for example, you only have a name or address, you can be able to through services like ours, be able to get a full, comprehensive set of data on that customer, both firmographic, demographic, and credit information, and then be able to use that to promote to customers. [Gary Stockton]: So can you share some examples of how Experian data can help marketers hone in on their target customer, for example, how SICs and NAICS codes can help? [Tony Romero]: Yeah, Gary, you're right. SIC and NAICS codes provide information about what industry the business is in. And so, by knowing that, you're able to target those consumers. So again, as I mentioned before, you can take a look at your existing customer base and find out who's your ideal target customer. And from that, then you can compare that to prospective businesses that look just like that. And that's what's called a lookalike analysis. And by using SIC and NAICS codes, you're able to use that to segment the market and then be able to promote effectively. And Gary, you also mentioned that with the economic state, CMOs have to watch their budgets and be as efficient as possible these days. So again, by doing very good segmenting of your target audience, you are making sure that your finance and financial output to a campaign are as efficient as possible. [Gary Stockton]: Excellent, regulators, they're focusing on diversity, equity, and inclusion. How can Experian help clients in that effort? [Tony Romero]: You know? Yeah. That's a very key point and definitely more than ever. It's important to focus on identifying your existing portfolio and seeing how many customers in your portfolio are minority-led or women-led businesses. So you can do benchmarking, you can see how you fare against other businesses in your market space. And that helps you to determine how much more do you need to market to these minority or women-led businesses. So what's number one is the benchmarking, but secondly, you need to be able to go out and look at your prospective target list and find out who are minority-led or women-led. And there, getting an indicator about a Woman-led or Minority-led business allows you to promote specifically to those types of businesses to help increase your portfolio. [Gary Stockton]: That's good. So if all I have is a name and an email address, and in a lot of cases, you know, if we're driving a newsletter, can I still profile this contact? Or are there other ways to do that with minimal info? [Tony Romero]: Yes, there is. You know, even just having a name and address is enough data to go through our type of service and be able to append all of the other information that we talked about, whether it's firmographic with SIC or NAICS codes, it could be demographic information where we look at the business and find out who the consumers that are tied to that business are? So that's called a B2C linkage. And from that now, you know who the actual individual is and go target those specific individuals. So that's also another key point to bring out [Gary Stockton]: Excellent stuff, Tony. Well, folks, if you enjoyed this chat and want to go a level deeper, don't miss Tony's campaign targeting Sip and Solve webinar – Fine Tuning B2b Campaign Targeting. He goes into greater detail on targeting B2B prospects, just click the image to be taken over to the recording.

Published: Aug 23, 2022 by Gary Stockton